The 2025 State of Production Health survey, created with IndustryWeek, reveals a manufacturing industry undergoing profound transformation, where success increasingly depends on creating interconnected ecosystems and robust internal frameworks. But when we zoom in on the food and beverage sector, a unique story emerges—one of an industry charting its own course through familiar yet intensifying challenges, especially around ensuring the reliable moving of goods.

Supply Chain Takes Center Stage

While manufacturers across eight industry verticals ranked digital change management and disparate vendors/disconnected ecosystems as their primary production concerns for the next 18 months, food and beverage companies stand apart. A significant 15.7% of food and beverage leaders identified supply chain issues as the biggest factor that could limit their ability to meet production targets—making them the only manufacturing vertical to rank supply chain problems as their top roadblock.

This divergence isn’t coincidental. Recent trade disruptions and tariff volatility have hit food manufacturers particularly hard, forcing them to prioritize supply chain security and flexibility amid rising costs and mounting pressures. The ripple effects of geopolitical uncertainty are pushing food and beverage companies to fundamentally rethink their sourcing strategies and supplier relationships.

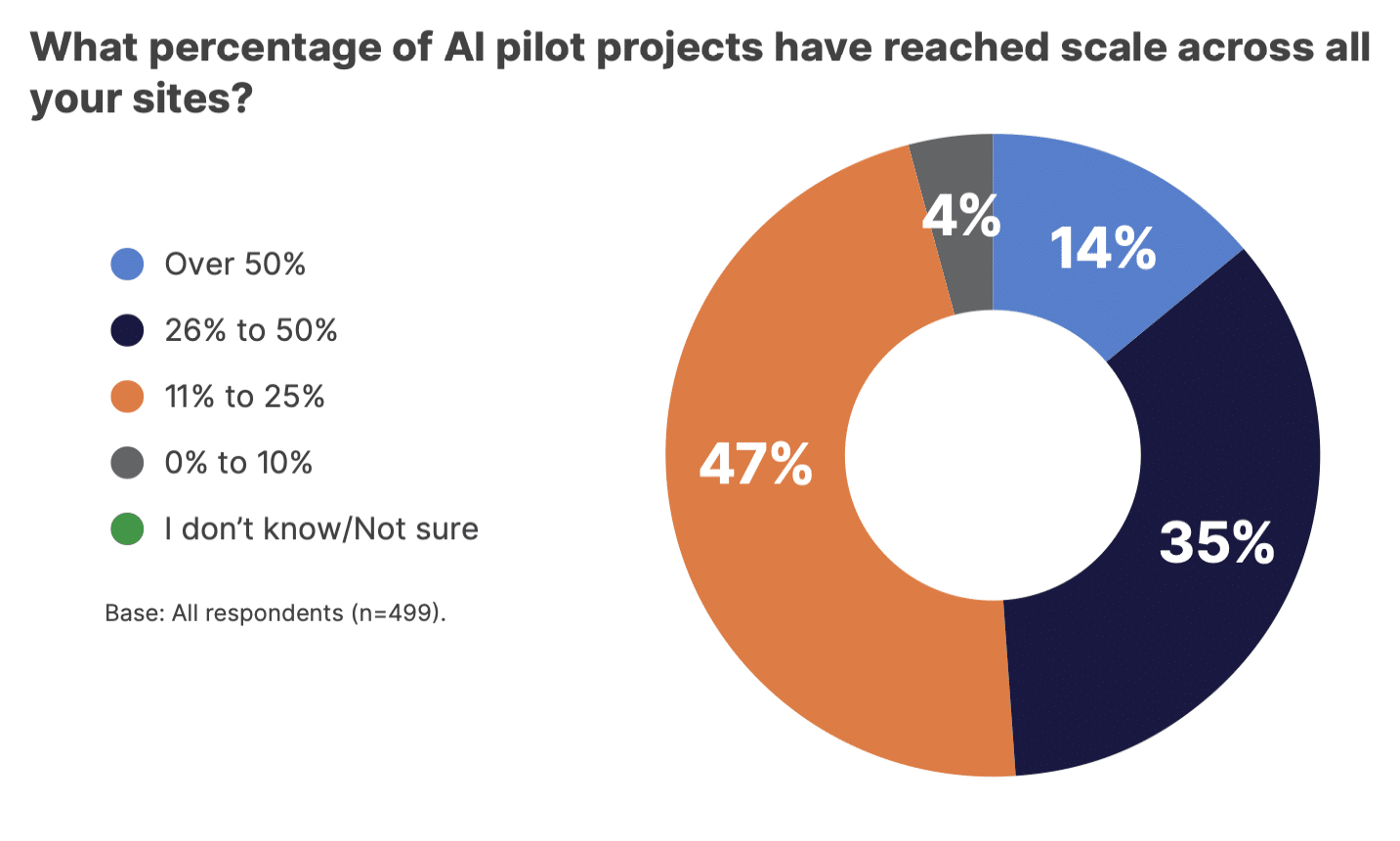

Despite their supply chain concerns, food and beverage manufacturers are showing impressive progress in AI adoption and scaling: 16% of food and beverage leaders report that more than half of their AI projects have reached scale across all sites.

What makes this even more telling is how the broader manufacturing landscape has shifted its focus. When it comes to quantifying AI impacts across all verticals, supply chain management and optimization actually fell by four ranking slots compared to 2024. As the report suggests, manufacturers may be addressing tariff challenges more through cost accounting and pricing adjustments rather than fundamental sourcing arrangements—though the food and beverage industry seems to recognize they’ll need to work both fronts going forward.

AI Progress Despite Supply Chain Focus

Despite their supply chain concerns, food and beverage manufacturers are showing impressive progress in AI adoption and scaling. The numbers tell an encouraging story: 16% of food and beverage leaders report that more than half of their AI projects have reached scale across all sites. This places them as the second-highest performing sector, trailing only pharmaceutical manufacturers’ remarkable 30%.

This success becomes even more significant when viewed against the industry-wide triumph over “pilot purgatory.” Across all manufacturing verticals, the percentage of companies successfully rolling out AI solutions beyond pilot phases more than tripled from 4% to 14% between 2024 and 2025. Food and beverage companies are clearly riding this wave of maturation, demonstrating that supply chain challenges haven’t derailed their digital transformation efforts.

Food and beverage leaders outpaced the industry as a whole when it comes to AI pilots, with 16% scaling more than half of all projects compared to the 14% industry average.

The Confidence Paradox

Also intriguing is where food and beverage manufacturers rank in terms of confidence. They’re the second-most confident sector when it comes to rating their organization’s ability to meet full production potential, with an impressive 92% of respondents expressing confidence in their production capabilities.

However, the report raises a critical question about whether this confidence might be misplaced. When examined alongside ongoing operational challenges—capacity constraints, supply chain disruptions, and workforce issues—these high confidence levels begin to look like what the report calls “false confidence,” a state that blinds organizations to critical problem areas.

The Digital Advantage

One area where food and beverage companies demonstrate genuine strength is in their ecosystem connectivity. The survey revealed that “disparate vendors/disconnected ecosystems” ranked much lower for food and beverage respondents compared to the manufacturing industry as a whole. These skills are increasingly valuable in today’s industrial landscape, where success depends not just on individual technologies but on how well different systems, vendors, and partners can work together seamlessly. Food and beverage manufacturers appear to have cracked this code better than most.

When examined alongside ongoing operational challenges—capacity constraints, supply chain disruptions, and workforce issues—these high confidence levels begin to look like what the report calls ’false confidence,’ a potentially dangerous state that might blind organizations to critical problem areas.

They are also betting big on AI’s future. They rank among the sectors most likely to increase AI spending significantly, with 83% planning to spend more on AI in 2025. This substantial investment, combined with their success in scaling AI projects, suggests an industry that recognizes technology as essential to navigating their unique challenges.

The Path Forward

The food and beverage industry finds itself in a unique position within the broader manufacturing ecosystem. Here’s how the vertical can best move forward:

- Tackle supply chain volatility, which shows no signs of abating, by identifying AI solutions that provide insights and real-time flexibility

- Guard against overconfidence and maintain honest assessments of where production truly falls short

- Maintain focus on digital transformation and vendor integration, a strength for the vertical that will continue to pay dividends

- Build on AI scaling success driven by leveraging advanced technologies and making implementation an org-wide goal

As trade policies continue to shift and supply chain pressures mount, the companies who combine their demonstrated technological capabilities with realistic assessments of their challenges will be best positioned to thrive in an uncertain landscape.

See Industrial AI in action. See how PepsiCo is winning with machine data and scaling predictive insights across their their plants.

Want to learn more about the study’s findings? Watch expert panelists discuss opportunities and trends you can apply to your operations on The State of Production Health 2025 webinar.